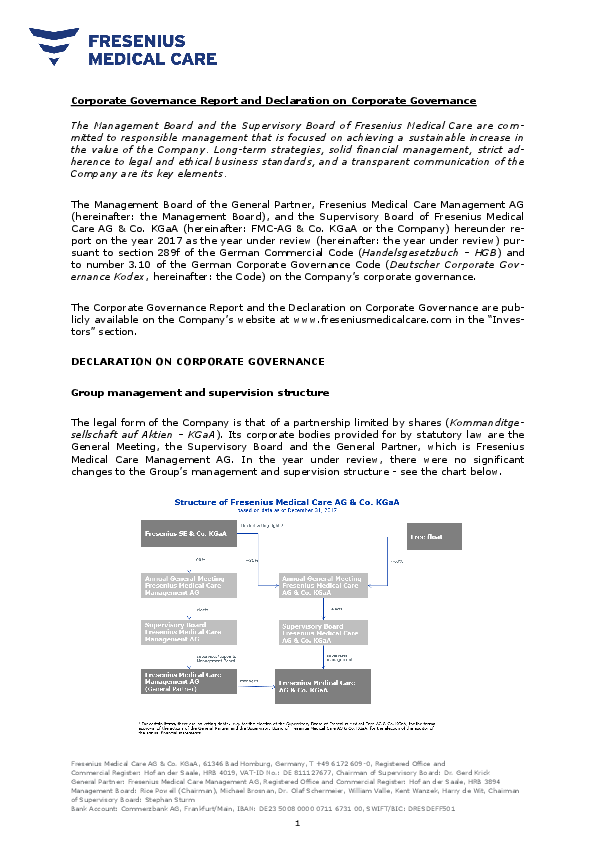

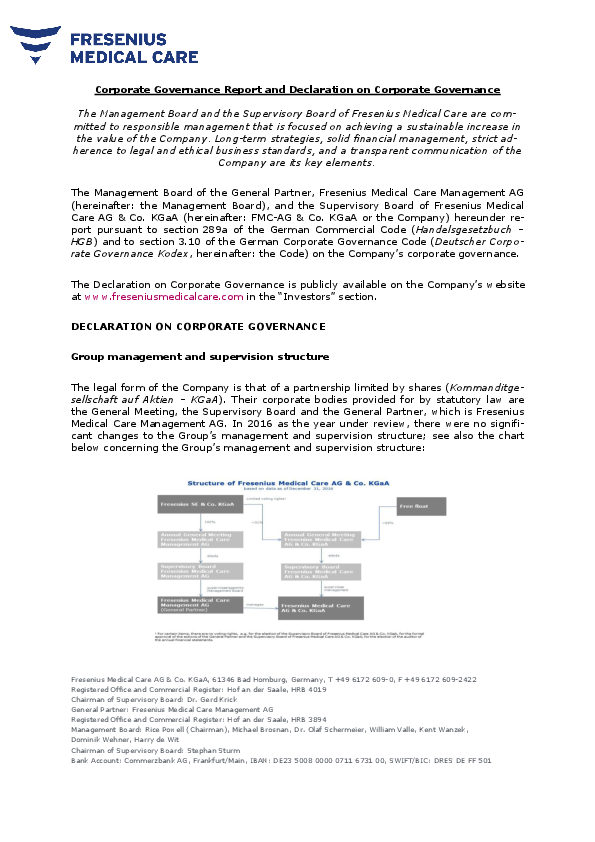

Declaration on Corporate Governance

The Management Board and the Supervisory Board of Fresenius Medical Care are committed to responsible management that is focused on achieving a sustainable increase in the value of the Company. The implementation of long-term strategies, solid financial management, strict adherence to legal and ethical business standards, successful sustainability management to create lasting economic, ecological and social value, and a transparent communication of the Company are its key elements.

The Management Board and the Supervisory Board of Fresenius Medical Care AG (Company) report below on the fiscal year 2023 (the year under review) pursuant to Sections 289f, 315d of the German Commercial Code (Handelsgesetzbuch – HGB) and in accordance with principle 23 of the German Corporate Governance Code in the version dated April 28, 2022 (GCGC), as published in the German Federal Gazette (Bundesanzeiger) on June 27, 2022, on the Company’s corporate governance (Unternehmensführung) and also comment on recommendations and suggestions of the GCGC.